COEUR D’ALENE, Idaho, April 18, 2023 (ACCESSWIRE) – Idaho Strategic Resources (NYSE American: IDR) (“IDR” or the “Company”) is pleased to announce an exploration crosscut intercepted the “H-Vein” at the Golden Chest Mine on March 29th, cutting a strongly mineralized vein that assayed 32.1 grams per tonne (gpt) gold over 0.43 meters on the northern rib and 54.1 gpt over 0.72 meters on the southern rib. Both samples represent true thickness. The H-Vein lies 60 meters (m) west of the Idaho Vein at the 794 elevation in the hangingwall of the Idaho Fault, which is why it is referred to as the H-Vein. The H-Vein is a banded quartz vein known to lie immediately below the Timber King Fault. Both fault and vein zone strike northerly and dip from 70 to 75 degrees to the west. Previous drilling by IDR had identified this vein zone when drilling for targets along the Idaho Vein.

This vein system consists of both a banded quartz vein as well as the adjacent silica-flooded zone bearing strong pyrite. The banded vein exhibits abundant visible gold with associated pyrite, galena, chalcopyrite, and sphalerite. IDR’s chip samples of the banded vein show assay values ranging between 29 gpt to 73.7 gpt gold. Widths of this banded vein are from 0.4 to 0.72 meters. The adjacent silica-flooded unit is hard, dark-colored and has 3-5 % auriferous pyrite.

Muck samples are collected from each 2.5 m long round during drifting and are anticipated to be representative of the diluted grade that can be expected at the mill. Initial drifting along the vein has yielded an average muck sample grade of 25.1 gpt for 24.8 meters of strike length. The H-Vein material is currently being shipped to the mill so the gold grade of the muck samples can be confirmed.

Idaho Strategic’s VP of Operations, Grant Brackebusch added, “I’m excited about the drifting results on the H-vein because of the high gold grades encountered, and the attitude of the vein which may allow for a more efficient mining method. If our drifting continues to show high grades over increasing strike length, our production emphasis will quickly shift from the Skookum to the H-vein because it’s readily accessible from our existing ramp. Additionally, the discovery of the H-vein in the hangingwall of the Idaho Fault opens our eyes to the exploration potential for other steeply dipping, high grade veins in that area. Given the H-Vein’s location near the Main Access Ramp (MAR), and the early indication of high gold grades, the H-Vein could increase the gold ounces sent to the mill without increasing development costs.”

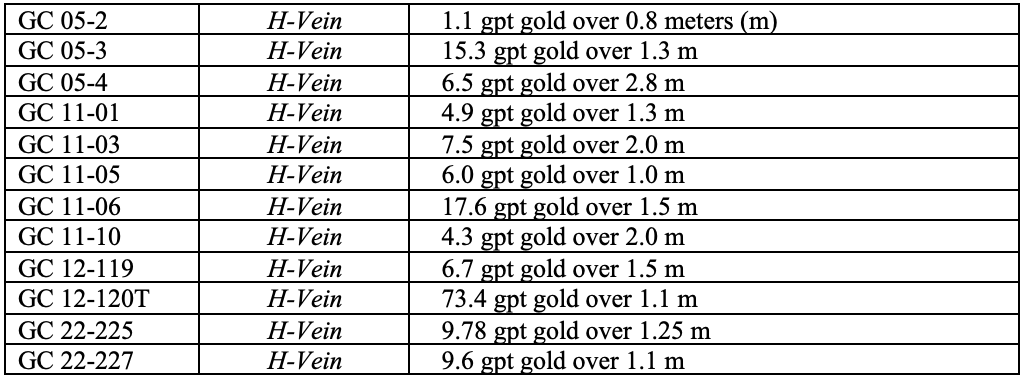

The H-Vein was first noted in three core holes drilled by IDR in 2005. More drilling during a large (18,034 meters) 2011-2012 surface diamond drill program, and two holes in 2022, further defined the H-Vein in nine additional intercepts.

Drill intercepts for the H-Vein are shown in the table below and are reported in drill thickness (not true thickness) and in grams of gold per tonne (gpt).

The plan to explore and possibly develop the H-Vein into another production area starts with the current drifting program to explore the H-Vein laterally on strike to the north and south at the 794 elevation. The continuity of the vein at this depth is unknown since the 794 Drift is lower than all but one of the drillholes (GC 11-06: 17.6 gpt gold over 1.5 m) which intercepted the H-Vein 90 meters south of the current face at about the same elevation. The second step in the plan will be to extend a crosscut from the 812 Sublevel and intersect the H-Vein and drift along the vein at the 812 elevation, again along strike to the north and south.

If ore tonnage blocks are identified by the exploration drifting, they will represent a highly accessible, near-term source of mill feed. The steep dip of the H-Vein means that it is potentially amenable to Long-Hole Stoping methods which would be lower cost and offer less dilution than the current Underhand Cut-and-Fill method employed on the Idaho Vein. Long-Hole Stoping would require competent wallrock so the drifting process will allow for geotechnical observations of the adjacent rock to help in the planning and engineering of future mining methods.

The H-Vein was included in the updated Mineral Resource for the year ending December 31, 2022. It made up a small portion of the total Skookum resource with 94,770 tonnes of Measured and Indicated Resource grading 4.3 gpt. Initial exploration drifting is taking place on the margin of the Inferred Resource area and initial results show significantly higher grades than the block model predicted. These initial results suggest that the H-Vein Resource may be remodeled to a higher grade and even possibly reserve classification with additional drifting up and down dip and with further exploration drilling.

Qualified person

IDR’s Vice President , Grant A. Brackebusch, P.E. is a qualified person as such term is defined under S-K 1300 and has reviewed and approved the technical information and data included in this press release. All reported assays are 30-gram fire assays with a gravimetric finish completed by American Analytical, Inc. of Osburn, Idaho. A QA/AC program includes a series of blank, standard, and duplicate sample assays for verification and quality control.

About Idaho Strategic Resources, Inc.

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth elements properties (in Idaho), the largest known concentration of thorium resources in the U.S., and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d’Alene Mining District, north of the prolific Silver Valley. With over 7,300 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more “at-risk” Rare Earth Elements (REEs) with an overall land position of approximately 18,030 acres in Idaho’s REE-Th Belt. The Company’s Diamond Creek, Roberts, and Lemhi Pass REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. IDR’s Lemhi Pass REE-Thorium Project is also recognized by the USGS and IGS as containing the largest concentration of thorium resources in the country. All three projects are located in central Idaho and participating in the USGS Earth MRI program.

With an impressive mix of experience and dedication, the folks at IDR maintain a long-standing “We Live Here” approach to corporate culture, land management, and historic preservation. Furthermore, it is our belief that successful operations begin with the heightened responsibility that only local oversight and a community mindset can provide. Its “everyone goes home at night” policy would not be possible without the multi-generational base of local exploration, drilling, mining, milling, and business professionals that reside in and near the communities of the Silver Valley and North Idaho.

For more information on Idaho Strategic Resources click here for our corporate presentation, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as “intends”, “potential”, “believe”, “plans”, “expects”, “may”, “goal’, “assume”, “estimate”, “anticipate”, and “will” or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, Idaho Strategic Resources targeted production rates and results, the expected market prices of gold, individual rare earth elements, and/or thorium, as well as the related costs, expenses and capital expenditures, the potential advancement of the Company’s projects, the potential development of the H-Vein, the economics of the H-Vein, and the potential for the H-Vein to allow for reduced mining costs. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks, if they occur, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company’s projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.