COEUR D’ALENE, Idaho, February 18, 2021 (ACCESSWIRE) — New Jersey Mining Company (OTCQB:NJMC) (“NJMC” or the “Company”) is pleased to announce further high-grade results from its core drilling program at the Golden Chest. These high-grade gold intercepts are from recent exploration drilling in the Paymaster Shoot (“Paymaster”). All reported intervals are the true thickness of the vein.

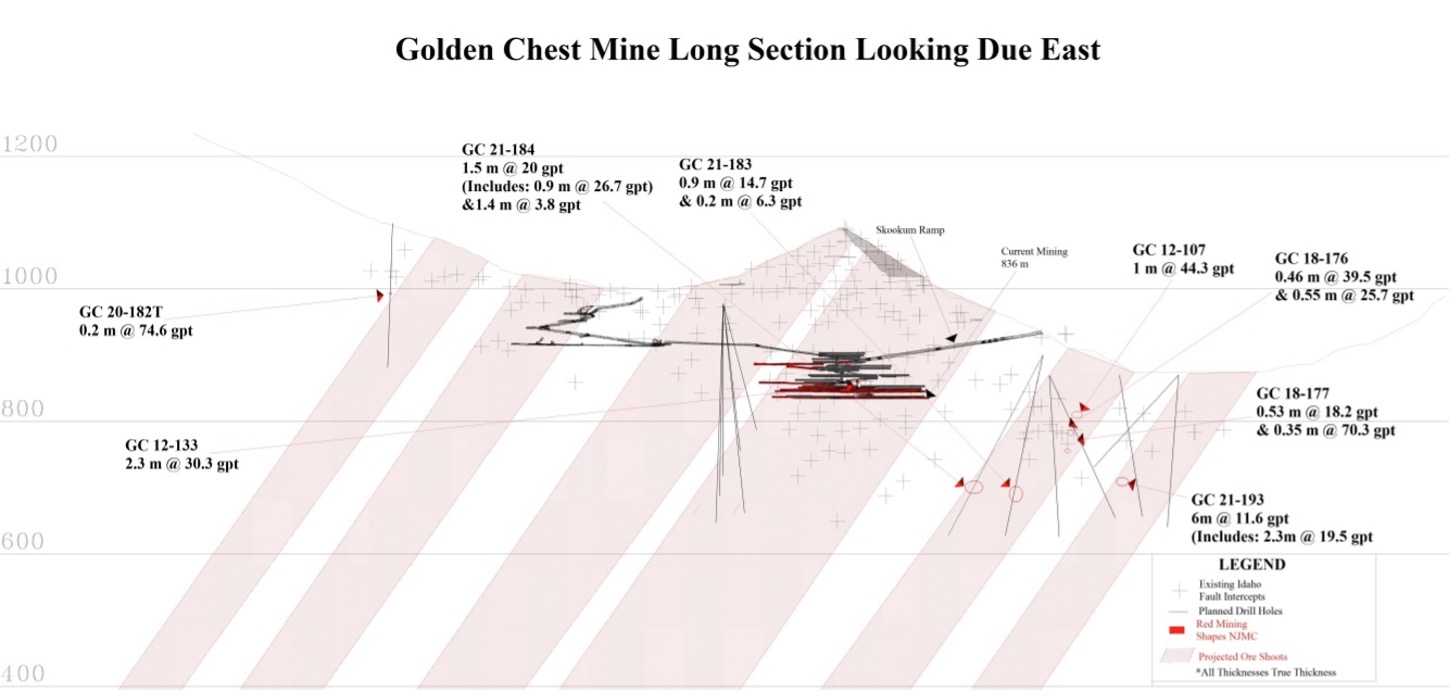

- GC 21-184 intercepted 1.5 meters of 20.1 gpt gold (including 0.9 meters of 26.7 gpt gold) in the upper vein and 1.4 meters of 3.8 gpt gold in the lower vein.

- GC 20-183 intercepted 0.9 meters of 14.7 grams per tonne (gpt) gold in the upper vein and 0.2 meters of 6.3 gpt gold in the lower vein.

NJMC President and CEO John Swallow commented, “The methodology and success ratio of this drill program is impressive. And with the high-grade intercepts from both the Joe Dandy and the Paymaster, we are watching in real-time as our ‘production-supported ore shoot model’ transforms from a highly confident geologic theory into a drill-proven and geologic reality.”

Mr. Swallow continued, “Along with the results stated above, a significant additional vein assaying 104 gpt gold over 0.4 meters was encountered in hole GC 21-184. This intercept is located 47 meters above the Idaho Fault and may represent a promising supplementary mineralizing control. At this time the true thickness is unknown.”

NJMC’s VP of Exploration, Rob Morgan states, “This 2021 ore shoot drill program is focused on our ‘Deep Rooted’ ore shoot model and designed to prove vertical continuity by intercepting deeper ore grades in each of our six identified ore shoots. These drill intercepts step out approximately 100 meters along strike from previous 2018 high-grade exploration intercepts in holes GC 18-176/GC 18-177 and 45 meters down dip from 2012 ore-grade exploration intercepts in holes GC 12-123/GC 12-130. To date, this process has proven successful and demonstrated the Paymaster and Joe Dandy Ore shoots both improve in gold grade down-dip from previous high-grade intercepts encountered in our 2012 and 2018 exploration programs, respectively.”

Mr. Morgan continues, “Drill holes GC 20-183 and GC 21-184 targeted down dip extensions of gold bearing quartz veins in the Paymaster Shoot. These holes now represent the deepest ore intercepts in the Paymaster Shoot to date and show further vertical continuity of the ore shoot system at the Golden Chest (see Golden Chest Long Section below). The drill holes encountered both upper and lower veins which flank a monzonite sill and are characteristic of the Paymaster area. The Paymaster claim, established in 1883, has the honor of being the first hard rock lode claim in the Coeur d’Alene Mining District and predates the discovery and establishment of the world-class Silver Valley.”

The Golden Chest deposits are similar to the deposits of the Coeur d’Alene District, in that the vertical extents of the ore shoots are often greater than the horizontal. The two districts may or may not be genetically related, but there are definitely structural similarities. At NJMC, we consider the Murray Gold Belt to represent the gold zone adjacent to the greater Coeur d’Alene District silver-lead-zinc zone.

Quality assurance/quality control

All of the samples were analyzed by American Analytical of Osburn, Idaho, an ISO certified laboratory. Samples were analyzed using lead collection fire assay with a gravimetric finish. A series of known assay standards are submitted with each drill hole as part of a quality assurance-quality compliance program.

Qualified person

NJMC’s Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

About New Jersey Mining Company

Headquartered in North Idaho, New Jersey Mining Company is the rare example of a vertically integrated, operating junior mining company with exposure to gold and rare earth elements. NJMC produces gold at the Golden Chest Mine and recently consolidated the Murray Gold Belt (MGB) for the first time in over 100-years. The MGB is an overlooked gold producing region within the Coeur d’Alene Mining District, located north of the prolific Silver Valley. In addition to gold, the Company maintains a presence in the Critical Minerals sector and is focused on identifying and exploring for Critical Minerals (Rare Earth Minerals) important to our country’s defensive readiness and a low-carbon future.

New Jersey Mining Company possesses the in-house skillsets of a much larger company while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings on its own or with a strategic partner in a manner that is consistent with its existing philosophy and culture.

NJMC has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine. Management is stakeholder focused and owns more than 15-percent of NJMC stock.

The Company’s common stock trades on the OTC-QB under the symbol “NJMC.”

For more information on New Jersey Mining Company go to www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@isr.edsandbox.com

(208) 625-9001

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Such statements are based on good faith assumptions that New Jersey Mining Company believes are reasonable, but which are subject to a wide range of uncertainties and business risks that could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such factors include, among others, the risk follow on drill success in identified ore shoots in the Pay Master Vein at the Golden Chest Mine may not result in mineable widths, increased production or a larger resource, the risk the mine plan changes due to rising costs or other operational details, an increased risk associated with production activities occurring without completion of a feasibility study of mineral reserves demonstrating economic and technical viability, the risks and hazards inherent in the mining business (including risks inherent in developing mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and the potential impact on revenues from changes in the market price of gold and cash costs, a sustained lower price environment, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic as well as other uncertainties and risk factors. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. NJMC disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise.