COEUR D’ALENE, Idaho, November 16, 2020 (ACCESSWIRE) — New Jersey Mining Company (OTCQB:NJMC) (“NJMC” or the “Company”) today announced its consolidated operating and financial results for the third quarter of 2020. The full version of the Company’s interim unaudited consolidated financial statements and management’s discussion and analysis (MD&A) can be viewed on the Company’s web site, and EDGAR. All amounts are expressed in U.S. dollars unless otherwise specified.

NJMC President and CEO, John Swallow stated, “As indicated in the bullet points below, the quarter was one in which the first of our two sources of revenue (surface operations) largely covered the necessary development programs (and corresponding lack of ore production) from our second revenue source, the underground operations. I feel that when we look back at the business one day, that this era will represent the time in which our “production-based” approach to business expansion, district consolidation and exploration longevity more formally pivoted toward the future. Until recently the various challenges (and opportunities) of corporate base building, downside business/stakeholder protection, etc. garnered much of our quarterly and other discussion. And now, with a very high mining and milling hurdle behind us, we are in a time of increased development and expansion (surface, underground, drilling, addition of rare earth element properties, etc.) and in our experience, some choppiness within all of these moving parts is not totally unexpected. We have now added the necessary equipment and personnel – and given the global backdrop – our ability to produce, grow and diversify the business in 2020 says a lot about our team and the folks on the front line.”

Highlights during the third quarter of 2020 include:

- The quarter was a largely a transitional time for operations at the Golden Chest. Production from the lower portion of the Idaho Pit had concluded in the 2nd quarter and subsequent development and production began from a nearby area. In addition to moving waste material prior to mining, as anticipated, this portion of the pit was comprised of lower grade material. Typically lower grade ore is combined with higher grade underground ore, however the underground was focused on backfill and new development – and instead of mostly mining ore, a significant amount of time was spent by the underground crews placing cemented rock fill (CRF) in mined out stopes to prepare for mining the lower cuts on those stopes. To better illustrate, a total of 2,920 cubic meters of CRF were placed which was 2.4 times more CRF than was placed in the prior quarter. The underground mining rate has increased considerably since that work was completed near the end of the 3rd quarter.

- As part of our pivot toward increased underground mining and development, a second crew of underground miners were hired to increase the production rate of the underground mine. Furthermore, additional mining equipment such as a loader and jumbo drill were acquired to facilitate the increased mining rate. A night shift was added just after Labor Day and a significant increase in production has been observed since that time. A total of 5,750 tonnes were mined (mineralized material and waste) in the quarter doubling the previous quarter as well as increasing the backfilling rate as mentioned above. Deepening of the Main Access Ramp (MAR) also started with the addition of the second mining crew. Focus on the Main Access Ramp is critical to underground expansion and additional stopes. We chose this quarter as the time to increase backfill rates while continuing to conduct development on both the surface and underground.

- During the quarter, the Company hired a driller and drill helper as its designated in-house drill crew – as opposed to pulling our drill crew from the mill and potentially impacting those operations. One of the Company drills is now focused on the lower reaches of the Katie Dora and Klondike shoots and will expand its focus toward step-out exploration drilling in the coming months.

- For the quarter ending September 30, 2020 a total of 11,440 dry metric tonnes (dmt) were processed at the Company’s New Jersey mill with a flotation feed head grade of 2.18 grams gold per tonne (gpt) with gold recovery of 84.3%. Interestingly, the ball mill feed grade for the quarter was 3.05 gpt gold indicating there may a significant quantity of gold trapped in the grinding circuit given the tonnage throughput for the quarter. The periodic ball mill clean-out will occur in the fourth quarter to determine how much gold is trapped in the mill. Gold sales for the quarter were 836 ounces.

- Open pit mining progressed from the 1056 bench to the 1044 bench as production averaged 1,785 tonnes per day.

- As part of its dual-pronged approach, the Company further expanded its strategic Critical Minerals focus with the addition of the Roberts Rare Earth Element (REE) Project, located near its Diamond Creek Project in central Idaho. The Roberts REE Project is comprised of 12 unpatented mining claims covering an area of approximately 89 hectares (219 acres). This Project is located within the Mineral Hill Mining District, approximately 48 kilometers (30 miles) northwest of the town of Salmon, Idaho. Recent sampling by Company geologists returned grades in excess of 12% combined rare earths elements. Similarly, as with NJMC’s Diamond Creek project, REE’s are not the only valuable commodities found on the properties; gold and niobium are also present according to historic information and NJMC sampling, and both may prove to be desirable by-products if these properties advance to production. Recently collected samples from the Roberts property show assays with gold values up to 8.8 grams per tonne (0.25 ounce per ton) and niobium as high as 0.50%.

- In August 2020, the Company completed a private placement for $2.7 million, which will accelerate a drill program targeting down-dip gold resource expansion and necessary underground mine development to facilitate the goal of doubling production over the next 12-18 months at the Company’s Golden Chest mine in Idaho.

Corporate Highlights include:

- The Company achieved revenue (from operations) of $1,556,070 and $4,281,401 for the three and nine-month periods ending September 30, 2020 compared to $1,852,636 and $4,544,964 for the comparable periods of 2019. The 2020 decrease was a result of expected lower gold grades, the development of the new open pit area and underground operations being focused on development and expansion.

- As described in Note 11 of the Consolidated Financial Statements, on April 10, 2020, the Company received a loan of $358,346 pursuant to the Paycheck Protection Program (the “PPP”) under Division A, Title I of the CARES Act. The Company qualified for PPP forgiveness therefore the amount of the loan that was recognized as grant income in the Company’s consolidated income statement included the original $358,346 in principal and $1,708 in accrued interest.

- The Company had a gross loss for the three and a gross profit for the nine-month periods ending September 30, 2020 of ($107,237) and $24,033 respectively, compared to a gross profit of $447,185 and $584,649 for the comparable periods in 2019. Gross profit decreased as a result of expected lower gold grades and development of the new open pit area and the transition of underground operations focused on development and expansion.

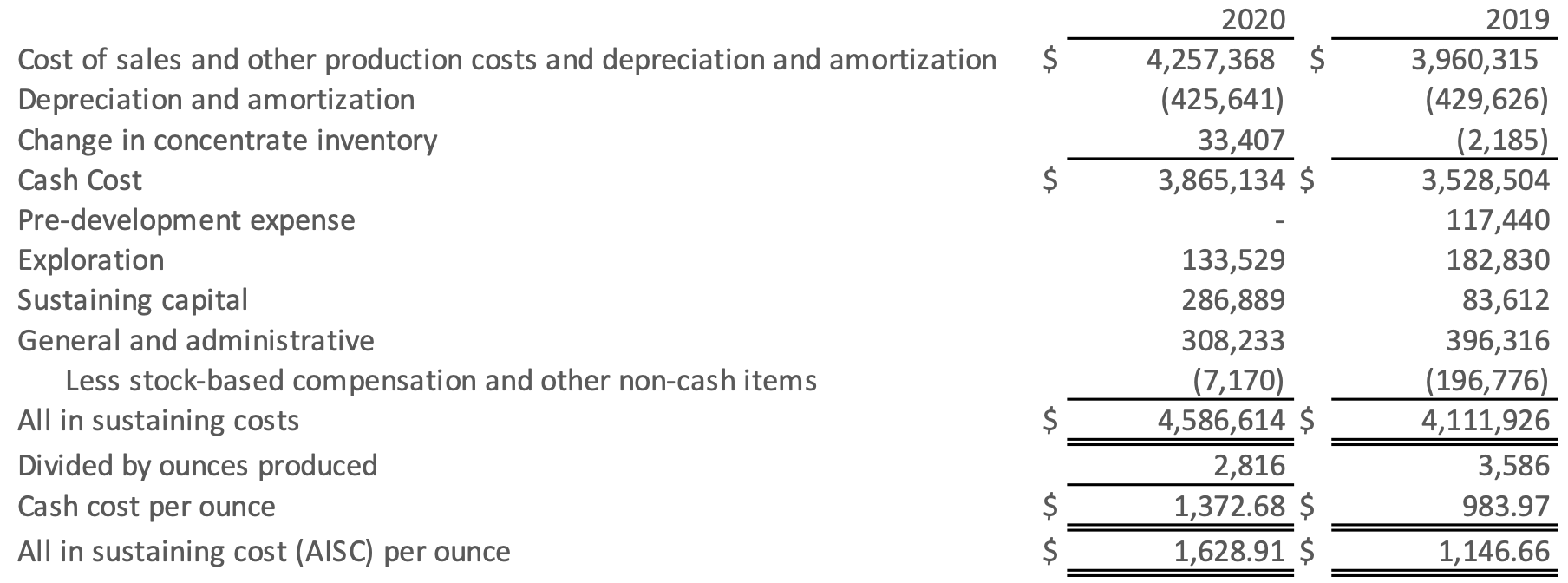

- Cash cost per ounce increased to $1,856 and $1,373 in the three and nine-month periods ending September 30, 2020 compared to $927 and $984 in 2019.

- The Company had a net loss of $7,327 and $382,028 (net of the PPP loan forgiveness proceeds mentioned above) for the three and nine-month periods ending September 30, 2020, respectively, compared to net income of $165,242 and net loss of $357,240 for the three and nine-month periods ending September 30, 2019.

- The consolidated net loss for the nine months ended September 30, 2020 and 2019 included non-cash charges as follows: depreciation and amortization of $425,641 ($429,626 in 2019), write off of equipment of $9,537 (none in 2019), accretion of asset retirement obligation of $7,170 ($6,757 in 2019), and stock based compensation of $0 in 2020 ($190,019 in 2019).

Cash Costs and All-In Sustaining Costs Reconciliation to GAAP-Reconciliation of cost of sales and other direct production costs and depreciation, depletion and amortization (GAAP) to cash cost per ounce and all-in sustaining costs (AISC) per ounce (non-GAAP) for the nine-month period ending September 30, 2020 and 2019.

The table above presents reconciliations between the most comparable GAAP measure of cost of sales and other direct production costs and depreciation, depletion and amortization to the non-GAAP measures of cash cost per ounce and all in sustaining costs per ounce for the Company’s gold production in the six month period ending June 30, 2020 and 2019.

Cash cost per ounce is an important operating measure that we utilize to measure operating performance. AISC per ounce is an important measure that we utilize to assess net cash flow after costs for pre-development, exploration, reclamation, and sustaining capital. Current GAAP measures used in the mining industry, such as cost of goods sold do not capture all of the expenditures incurred to discover, develop, and sustain gold production.

Qualified person

NJMC’s Vice President, Grant A. Brackebusch, P.E. is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

About New Jersey Mining Company

Headquartered in North Idaho, New Jersey Mining Company is the rare example of a vertically integrated, operating junior mining company. NJMC produces gold at the Golden Chest Mine and recently consolidated the Murray Gold Belt (MGB) for the first time in over 100-years. The MGB is an overlooked gold producing region within the Coeur d’Alene Mining District, located north of the prolific Silver Valley. In addition to gold, the Company maintains a presence in the Critical Minerals sector and is focused on identifying and exploring for Critical Minerals (Rare Earth Minerals) important to our country’s defensive readiness and a low-carbon future.

New Jersey Mining Company possesses the in-house skillsets of a much larger company while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings on its own or with a strategic partner in a manner that is consistent with its existing philosophy and culture.

NJMC has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine. Management is stakeholder focused and owns more than 15-percent of NJMC stock.

The Company’s common stock trades on the OTC-QB under the symbol “NJMC.”

For more information on New Jersey Mining Company go to www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@isr.edsandbox.com

(208) 625-9001

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Such statements are based on good faith assumptions that New Jersey Mining Company believes are reasonable, but which are subject to a wide range of uncertainties and business risks that could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such factors include, among others, the, the risk that the mine plan changes due to rising costs or other operational details, an increased risk associated with production activities occurring without completion of a feasibility study of mineral reserves demonstrating economic and technical viability, the risks and hazards inherent in the mining business (including risks inherent in developing mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and the potential impact on revenues from changes in the market price of gold and cash costs, a sustained lower price environment, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic as well as other uncertainties and risk factors. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. NJMC disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise